by Alex Suta (Széchenyi István University), Loránd Kedves (Széchenyi István University), Árpád Tóth (Széchenyi István University)

The adoption of eXtensible Business Reporting Language (XBRL) for annual corporate disclosures is reshaping data accessibility and analytical methodologies. This technical study explores how European companies use XBRL to enhance data standardisation, which facilitates large-scale financial and sustainability analyses for practitioners and researchers.

The role of financial reporting in decision-making

Financial reporting serves as a cornerstone for corporate transparency and accountability, providing essential information to investors, regulators, and other external stakeholders. According to the International Accounting Standards Board, its primary objectives are decision-usefulness—enabling informed investment and resource allocation—and stewardship, ensuring accountability for resources entrusted to companies [1].

General-purpose financial reports include structured financial data (e.g., balance sheets and income statements) and qualitative disclosures, such as risk management and sustainability initiatives [1]. Annual reports support critical activities like trend analysis, benchmarking, and regulatory compliance. However, the increasing complexity of global business environments and regulatory demands has necessitated a shift toward digitisation, paving the way for the global adoption of innovative reporting frameworks such as XBRL [2][3].

A framework for digital transformation

XBRL was developed to transform the accessibility and comparability of corporate reporting. Its taxonomy-based framework provides a standardised approach to structuring and tagging financial and non-financial data. The International Financial Reporting Standard’s (IFRS) taxonomy used in European digital reports includes more than 7,600 tags (concepts) that cover numeric, textual, and structural elements. These tags align with key report sections such as the statements of financial position or cash flow, and notes to the financial statements [2]. By encoding reports in XBRL, companies ensure that their disclosures are machine-readable, enabling automated processing and large-scale analysis.

Despite its potential, the adoption of digital reporting has faced significant challenges. Many companies rely on custom tags alongside the standardised IFRS taxonomy, which leads to inconsistencies and complicates comparisons. Additionally, a lack of robust IT infrastructure for processing XBRL reports limits its full utility. Errors in tagging and data duplication are common, requiring extensive cleaning and validation. The complexity of the taxonomy itself poses challenges for report preparers, increasing the likelihood of misinterpretation and non-compliance [4].

To address these challenges, our research developed a comprehensive framework for processing XBRL reports. This included retrieving 7,842 annual reports from the XBRL filings portal [L1] as of December 31, 2023, and employing a Java-based processing pipeline integrated with Python 3 tools. The extracted dataset was standardised to Euros using exchange rates from the European Central Bank, ensuring comparability across companies and periods. Stock-type data, such as balance sheets, utilised final-day exchange rates, while flow-type data, such as income statements, used period averages. The methodology also resolved inconsistencies in tagging by mapping custom tags to the closest IFRS equivalents and ensuring high data alignment.

Highlights from the total population analysis of digital reports

The analysed dataset comprised 3,469 companies with an average of 1.7 reports per company, and more than 3.2 million data points. Numeric disclosures accounted for 86.6% of the dataset, forming the backbone of financial analyses. Textual information, constituting 10% of the dataset, was primarily found in the notes sections of reports, which offer qualitative insights into corporate activities, such as accounting policies and even sustainability-related activities.

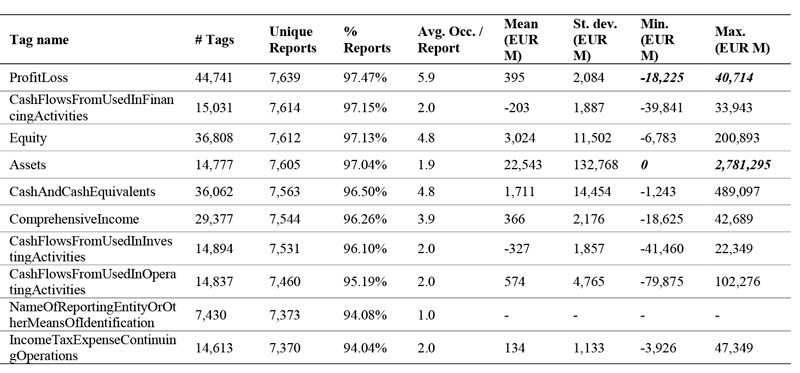

Key financial metrics, including Profit Loss and Equity, demonstrated high adherence to IFRS taxonomy standards, with 87% of tags aligning with the taxonomy. The analysis identified significant variability among companies, as presented by the descriptive analysis in Table 1. The transparency of data is achieved by the traceability of any data point to actual reports in their traditional human-readable format. According to the highlighted extreme values, Shell reported a maximum profit of € 40.7 billion, while Electricité de France (EDF) posted a record loss of € 18.2 billion from the population. Similarly, HSBC Holdings reported assets of € 2.78 trillion, contrasting sharply with the nil values reported by smaller entities like CoreCapital I K/S.

Table 1: Descriptive statistics on the most frequently used XBRL tags in 2022 reports.

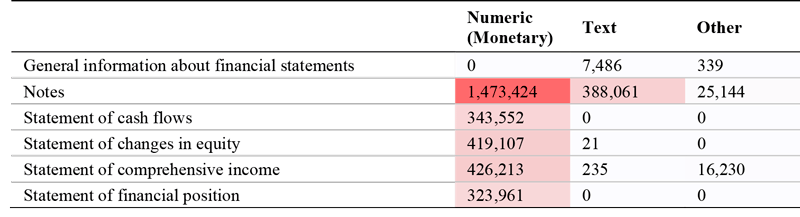

The identification of sustainability-related disclosures was another critical focus. Tags such as “DescriptionOf AccountingPolicyForEmissionRights” provided insights into companies’ environmental practices. Provisions related to environmental remediation appeared in over 11,000 instances, while contingent liabilities tied to sustainability risks were tagged more than 11,200 times. Such disclosures indicate that XBRL enables the integration of financial and sustainability reporting, which support a comprehensive approach to corporate transparency and responsibility [5]. Moreover, the distribution of data points across report sections reveals that the notes section contains the majority of numerical and textual disclosures, highlighting its importance in detailed financial and sustainability analyses, as presented in Table 2.

Table 2: Estimated data point distribution by annual report sections.

Although prior research has established the utility of the XBRL corporate reports as a primary source of data, their application to the entire European population has not been examined. As a contribution, the present work investigated the current state of digital business information disclosed in the recently accessible European electronic reports. The created knowledge base proves beneficial in extracting structured financial as well as business data presented in the notes to financial statements. As a result, the research questions set a good foundation for exploring potential uses of the data, with three potential application areas identified:

- Business information users and academic researchers can both benefit from the generated data tables and central knowledge base. The dataset is particularly useful for producing financial ratios and data visualisations for specific companies or industries and can facilitate more complex machine learning analyses, text mining, and Natural Language Processing (NLP) techniques directed at extracted qualitative data.

- In line with the European Union’s goal of expanding the implementation of XBRL by more companies, data-driven or free-text searches of existing reports could support report preparation capabilities and benchmarking activities.

- Large-scale report browsing for taxonomy preparers, including automatic detection of best practices, with additional support for standard creation consultation.

Links:

[L1] https://filings.xbrl.org

[L2] https://www.esma.europa.eu/issuer-disclosure/electronic-reporting

References:

[1] R. Ball, “What is the actual economic role of financial reporting?,” Accounting Horizons, vol. 22, pp. 427–432, 2008.

[2] IFRS Foundation, “Climate-related Disclosures—IFRS S2,” 2022. [Online]. Available: https://www.ifrs.org/projects/work-plan/climate-related-disclosures

[3] ESMA, “European Single Electronic Format,” 2022. [Online]. Available: https://www.esma.europa.eu/issuer-disclosure/electronic-reporting

[4] A. Suta, et al., “Overview of XBRL Taxonomy Usage for Structured Sustainability Reporting in European Filings”, Chemical Engineering Transactions, vol. 107, pp. 577-582, 2024.

[5] P. Molnár, et al., “Linking sustainability reporting and energy use through global reporting initiative standards and sustainable development goals”, Clean Technologies and Environmental Policy, pp. 1-9, 2024.

Please contact:

Alex Suta, Vehicle Industry Research Center, Széchenyi István University, Hungary