by Gerard Torrent

Financial institutions need tools to simulate their credit portfolios in the same way that they simulate their equity portfolios. CreditCruncher allows each payment in a massive loan portfolio to be simulated, taking into account the probability of default for each creditor and the correlations between them.

While the portfolios of loans given to SMEs and portfolios of corporate bonds do not have the glamour of the equity or foreign exchange markets, they are nevertheless the core business of many financial institutions. Such portfolios tend to have values of thousands of millions of dollars and may be composed of tens of thousands of small loans.

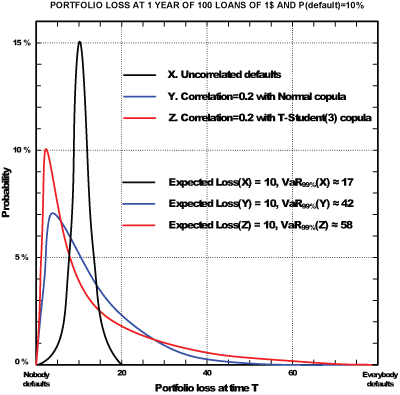

At first glance, credit portfolios may seem harmless because payments are based on pre-agreed dates. Nothing could be farther from the truth. Defaults frequently occur in clusters, affecting entire sectors of industry. The correlation between defaults is the main difficulty in risk assessment, and this is the rationale behind many of the approaches to credit risk valuation. The impact of the correlation on the loss distribution function is notorious, and causes an asymmetrical distribution function with long tails.

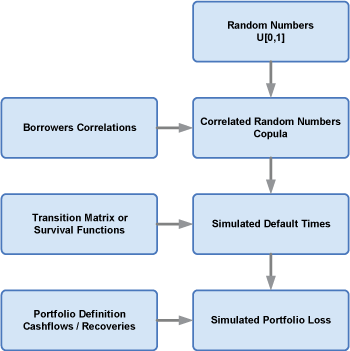

CreditCruncher is an open-source project for the simulation of massive portfolios of loans where the unique risk is the default risk. It is addressed to financial institutions searching for a well-documented and efficient tool. It consists of an engine that runs in batch mode and is designed to be integrated into the risk management systems of financial institutions for risk assessment and stress testing. The method used to determine the distribution of losses in the portfolio is the Monte Carlo algorithm, because it allows us to consider the majority of variables involved, such as the date and amount of each payment. This approach is conceptually equivalent to the valuation of portfolios of equities and derivatives using the Monte Carlo method. In the case of market risk, the price of the underlying assets is simulated using a geometric Brownian motion with a given volatility and trend. In the credit risk case, borrowers' defaults are simulated using a copula with given survival rates and correlations.

Sklar's theorem states that any multivariate distribution can be decomposed into two parts, the marginal distributions and a copula that reflects the structure of dependencies between components. This result is important because it allows us to separate the default probabilities from the default correlations.

CreditCruncher implements two of the most commonly used copulas in finance, the Normal and T-Student copulas. Because the default time of each borrower is modelled as a random variable, the size of the copula can be over 50,000, where each component represents a borrower. Simulating low-dimensional copulas poses no problem, but many of the algorithms operating in low dimensions are unsuitable for large dimensions. To solve this problem, the Cholesky decomposition was adapted to operate with a large correlation matrix composed of blocks, in order to reduce the memory space and the number of operations involved.

Each Monte Carlo run simulates the default time for each debtor by combining a copula sampling with the survival functions. This default time is used to determine the loss caused by the default, mitigated by an estimated recovery at a given time. The default amount is discounted to the present value using the interest rate provided by the yield curve. The sum of all losses provides the loss value of the portfolio for that simulation. The completion of thousands of simulations allows us to obtain the loss distribution function and compute the usual risk indicators, such as the Value at Risk or Expected Shortfall. Depending on the portfolio size and the required accuracy, the computational cost may be high; CreditCruncher is therefore compatible with execution in parallel computers.

CreditCruncher is currently a one-man project with no financial support, and is looking for collaborators with expertise in applied and/or theoretical financial mathematics to participate in a GPL (GNU General Public License) structure. The CreditCruncher system has been tested against both simple hand-made portfolios and large automatically generated portfolios. Future work is being considered to add stochastic recovery rates, pure risk operations like bank guarantees, and the creation of a graphical interface to make the tool available to the public, such as portfolio bond managers.

Links:

http://www.generacio.com/ccruncher/

http://sourceforge.net/projects/ccruncher/

Please contact:

Gerard Torrent

Spain

Tel: +34 606.179.518

E-mail: gtorrent![]() mediapro.es

mediapro.es