by Massimo Bernaschi, Maria Francesca Carfora, Albina Orlando, Silvia Razzano and Davide Vergni

Sovereign debt management is the process of establishing and executing a strategy for managing government debt. Among the main goals of a sound public debt management are i) to fulfil the funding requirements; ii) to minimize the cost of the debt and the related risk; and iii) to set up and control an efficient market for government securities. Our research is aimed at providing the mathematical tools for a cost/risk analysis of the portfolio of securities issued every month by the Italian Treasury. The final goal is to provide public debt managers with a flexible, efficient and user-friendly decision support tool.

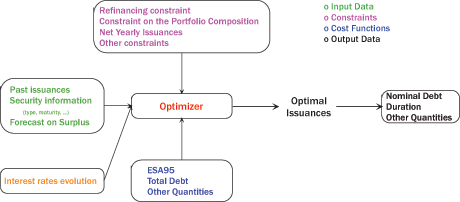

The Istituto per le Applicazioni del Calcolo Mauro Picone, part of the National Research Council of Italy, was founded in 1927 in Napoli by Prof. Mauro Picone as the first institute in the world devoted to the applications of calculus. Since 2002, the Institute has been involved in joint projects with the Italian Treasury that include high-level training on interest rate modelling for the Ministry staff. For the Department in charge of domestic public debt management, the Institute developed a software prototype that uses the simplex algorithm to determine, for a given scenario of interest rate evolution, the optimal sequence of public debt securities issuances. At the same time, this sequence must fulfil the constraints (imposed by the law or by market best practices) that Treasury must take into consideration. Figure 1 shows the block diagram for the optimization process.

Recently a contract has been signed for the extension of this prototype with Consip S.p.A, a company of the Ministry of Economy operating on services for the Ministry itself. The prototype was presented in several international contexts (eg World Bank) and has received great attention and appreciation for its utility.

The final goal of the project is to determine the optimal sequence of public debt securities issuance. To this aim, we will develop methodologies to simulate realistic scenarios for the dynamics of interest rates, taking into account the effects of the main macroeconomic variables. This is crucial to support a robust cost/risk analysis that includes the impact of macroeconomic changes (variations in monetary policy, modifications in the economic cycle etc) on debt management.

The strong correlation between every rate (regardless of its maturity) and the official rate as fixed by the European Central Bank (ECB) leads us to assume the latter as a reference rate and to consider all other rates as generated by a combination of this reference rate with a characteristic, maturity-dependent fluctuation. On the other hand, the impact of expectations of the future economic trend on the choices made by the ECB cannot be neglected. We must therefore include in our control methodology a model describing the ECB rate dynamics as a function of the main macroeconomic variables.

The project is being developed through six modules:

- Implementation of Markov Switching models to describe the dynamics of economic and inflation cycles, and subsequent validation on Italian and suitably aggregated European data. As far as inflation is concerned, we are comparing two options: modelling its dynamics by means of an exogenous variable relating the inflation cycle to the economic cycle (eg the output gap) and developing a bivariate model describing both cycles.

- Development of a jump-diffusion model for the ECB rate. Our working hypothesis is that the ECB interventions can be modelled as a combination of a Poisson process describing the intervention times of the ECB, and a Markov process accounting for the direction and width of such jumps. Such a model must be linked to the evolution of the economic cycle, by means of terms that vary depending on the recession or expansion phase.

- As a complementary step with respect to the model in 2, implementation of a 'forward-looking' Taylor rule to model the ECB rate dynamics. Both the models in 2 and 3 will be introduced in the software tool to offer multiple choices for the simulations.

- Evaluation, for both the models in 2 and 3, of the interest rate fluctuations with respect to the ECB official rate. The basic idea is that the ECB official rate is a reference rate and all the other rates are generated by a composition of this reference rate plus a characteristic maturity dependent fluctuation. Interest rates evolution will be described by means of different models (CIR, HJM, Nelson-Siegel). Powerful calibration techniques for the parameters will be implemented.

- Extension of the current software tool through i) development of modules for the simulation of the dynamics of macroeconomic variables; and ii) stochastic programming techniques that allow the uncertainty in the evolution of the control variables of the system to be included in the optimal strategy.

- Assessment of the risk associated with fluctuations in interest rates. Besides traditional risk measures such as Cost at Risk (CaR) and Expected Shortfall (ES), we are also exploring spectral measures and dynamic risk measures.

The final result will be an analysis with clear indications on the robustness of the securities emission strategy of the Italian Treasury.

Please contact:

Albina Orlando

Istituto per le Applicazioni del calcolo 'Mauro Picone' - CNR, Italy

Tel: +39 081 6132395

E-mail: a.orlando![]() na.iac.cnr.it

na.iac.cnr.it

Davide Vergni

Istituto per le Applicazioni del calcolo 'Mauro Picone' - CNR, Italy

Tel: +39 06 49270951

E-mail: d.vergni![]() iac.rm.cnr.it

iac.rm.cnr.it