by Miklós Rásonyi

Despite of providing a good fit to financial data, asset price models with a fractal structure have often been rejected as they contradict a basic principle of economic theory: that arbitrage should be absent. In light of new results, their role must be reconsidered.

In the Stochastic Systems Research Group of SZTAKI, our current research in mathematical finance (in cooperation with Paolo Guasoni, Boston University, and Walter Schachermayer, University of Vienna) has a three-fold objective. We wish to incorporate certain market imperfections (ie features of the stock exchange that are neglected in idealized settings) in our modelling of the trading mechanism; to reintegrate an important class of 'fractal-like' stochastic processes into mainstream quantitative finance; and to develop further tools for treating these processes in a mathematical finance context.

Market imperfections include brokerage fees, taxes and liquidity constraints (where certain products are not available in the required quantities at a given time). These imperfections have been mostly neglected in the mathematical framework. We are focusing on models where proportional transaction costs are taken into account: each time the investor buys or sells an asset a certain percentage (eg 1% of the transaction value) must be paid to the broker. One of our aims was to achieve a deeper understanding of continuous trading in these more realistic models.

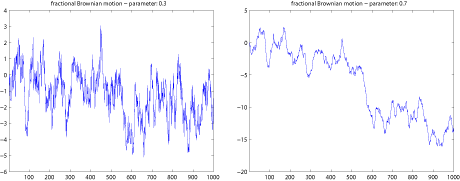

Identifying the right class of stochastic processes with which to model stock prices is of paramount practical importance. Ideally, a tractable class with a good fit to real data should be chosen. One family of stochastic processes, the so-called fractional Brownian motions, appears to be a promising candidate. These processes admit a fractal structure.

A fractal is generally thought of as a geometric object with rugged boundaries whose parts (however small they are) resemble the shape of the original, ie they show self-similarity. Most often they are recursively generated and hence ideal for computer implementations. There also exist stochastic processes with a self-similar structure, the prime example being Brownian motion. This is used to describe diffusive phenomena in physics and it serves as a basis for the overwhelming majority of current models in mathematical finance.

However, it is not the only fractal-like process of interest. Fractional Brownian motions are characterized by a number H ∈ (0,1) (the so-called Hurst index), which is related to their self-similarity properties but also affects the roughness of the sample paths: as H decreases, the trajectories of the process appear wilder and more chaotic. Standard Brownian motion corresponds to the case H=1/2 and is thus only one particular point in an interval of possibilities!

Determining the 'right' value of H for stock prices is nontrivial, and there is evidence that it may well be different from 1/2. Despite this, models with H ∈ 1/2 have so far been rejected as unsuitable. The reason is that if the stock price followed such a process then agents in the market would have an arbitrage opportunity, meaning they could produce a positive return from zero investment by clever trading. As arbitrage contradicts economic equilibrium, these processes were not much used in option pricing.

In light of our recent progress, there is hope that the situation will soon change. In cooperation with Paolo Guasoni (Boston University) and Walter Schachermayer (University of Vienna), we have shown that if proportional transaction fees are incorporated into the trading mechanism, stock prices can be modelled as fractional Brownian motion with any H. Not only does arbitrage then disappear, but one can also construct functionals to evaluate options.

We plan to go on with investigating these exciting models based on fractional Brownian motion and to develop option pricing techniques for them. One popular method is based on the preferences of investors: we wish to describe what strategy should be used to attain maximal satisfaction with respect to these preferences. This problem has strong links with optimal control, though it seems that the traditional approach (Bellmann principle) is useless for fractional Brownian motion models and we will need to apply alternative techniques.

We hope that these advances will lead to effective new methods for evaluating derivative securities in models that better approximate reality. In the near future, fractional Brownian motion may play a significant role in derivative pricing, which - as econometric investigations support - it deserves. We look forward to collaborating in these new developments.

Link:

See article no. 130 at:

http://www.mat.univie.ac.at/~schachermayer/pubs

Please contact:

Miklós Rásonyi

SZTAKI, Hungary

Tel: +36 1 2796190

E-mail: rasonyi![]() sztaki.hu

sztaki.hu