by Agnès Sulem and Antonino Zanette

PREMIA is a computational platform designed to set up a technology watch for numerical problems related to the evaluation of financial derivative products and the management of pertinent risks. It is developed by the MATHFI research team at INRIA.

Efficient computation of prices and hedges for derivative products is a major issue for financial institutions. The development of increasingly complex financial products requires advanced stochastic and numerical analysis techniques. The software PREMIA offers numerical solutions to the problems of pricing and hedging financial derivatives, with a collection of algorithms stemming from recent research in financial mathematics.

Premia has been developed in the framework of the MATHFI research team, which gathers researchers in probability and mathematical finance from INRIA, ENPC (Ecole Nationale des Ponts et Chaussées) and the University of Paris-Est Marne laVallée. The development of Premia started in 1999.

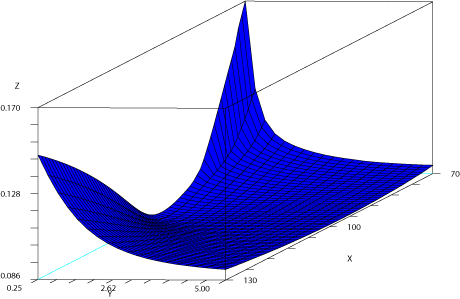

This project keeps track of the most recent advances in the field of computational finance. Premia contains various numerical algorithms: deterministic methods (finite difference and finite element algorithms for partial differential equations, wavelets, Galerkin, sparse grids etc), stochastic algorithms (Monte-Carlo simulations, quantization methods, Malliavin calculus-based methods), tree methods and approximation methods (Laplace transforms, Fast Fourier transforms etc). These algorithms are implemented for the evaluation of plain vanilla and exotic options on equities, interest rates, inflation, credit and energy derivatives. For equity derivatives for example, the multi-dimensional Black-Scholes is available as well as stochastic volatility (Heston, Hull-White, Fouque-Papanicolau-Sircar) and various Lévy models with jumps (Merton, Kou, Variance Gamma, normal-inverse Gaussian (NIG), Tempered stable). The most recent Monte-Carlo algorithms are implemented for high-dimensional American options. Various models of interest rate derivatives are included, as for example affine models, quadratic term structure models, Heath-Jarrow-Morton model and the Libor Market Model. Moreover, Premia provides a calibration toolbox for the Libor Market model, using a database of swaptions and cap implied volatilities and a toolbox for pricing credit derivatives (credit default swaps (CDS) and collateralized debt obligations (CDOs)) using the most recent algorithms.

The Premia software provides a collection of C/C++ routines and scientific documentation in PDF and HTML, and is available for both Windows and Linux operating systems. Interfaces for Excel and NSP/Scilab are available. More precisely, Premia is composed of (i) a library designed to describe derivative products, models and pricing methods, and which provides basic input/output functionalities; (ii) a unified numerical library (Premia Numerical Library (PNL)) available for contributors; (iii) a collection of pricing routines which can easily be plugged, if necessary, into other financial softwares; and (iv) a scientific documentation system.

The development of Premia is being undertaken along with a consortium of financial establishments. Consortium Premia is presently composed of CALYON, Natixis, Société Générale, Bank of Austria and RZB ((Raiffeisen Zentralbank Österreich). The participants in the consortium contribute to finance the development of Premia and help to determine the directions in which the project evolves. Every year, a new release is delivered to the consortium members. All algorithms implemented in Premia are provided with their source codes, solid research documentation and extended references. A restricted, open-source version of Premia is also available on the Premia Web site and can be downloaded with a special licence for academic and evaluation purposes.

Premia aids research and promotes technology transfer, creating a bridge between academic researchers and professional R&D teams. It supplies a benchmark for new numerical pricing methods and provides a useful teaching support for graduate students in mathematical finance.

Links:

http://www.premia.fr

http://www-rocq.inria.fr/mathfi/

Please contact:

Agnès Sulem

INRIA Paris-Rocquencourt, France

E-mail: agnes.sulem![]() inria.fr

inria.fr

Antonino Zanette

Universita di Udine, Italy

E-mail: antonino.zanette![]() uniud.it

uniud.it