by João Oliveira Soares

Diverse case studies carried out at CEGIST (Centre for Management Studies) at the Technical University of Lisbon have a common root: the support and analysis of investment decisions made by public authorities, banks and private firms. The approach comprises multiple dimensions and reflects on the use of statistical and quantitative methods along with qualitative criteria and judgment-based procedures. Recent work also adds flexibility and risk issues to this multidimensional context.

Daily we face numerous decisions. Many of these decisions are not subject to a formal process of analysis, but may implicitly incorporate multiple criteria and frequently involve uncertainty. A classical example is the choice of what to wear each day, which depends on the weather forecast, the agenda for the day, comfort and the image we wish to project. Despite this being a familiar occurrence to all of us, most of the decision models for investment analysis and resource allocation still try to capture the complex nature of decision processes with very simplified rules and one sole criterion. Our research at CEGIST goes in the opposite direction.

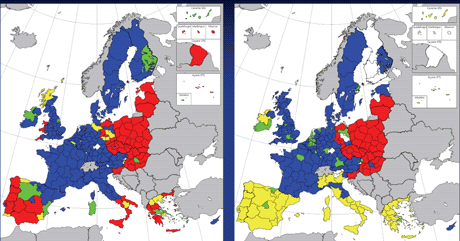

Let us start with an example at a macroeconomic level: the allocation of regional funds within the European Union. These funds represent a significant fraction (1/3) of the European budget, but are distributed based on a single indicator (GDP per head), which is used to segment the European regions (NUT 2). Such segmentation leads to very heterogeneous regions, and is insufficient for characterizing the types of dissimilarity among regions, which is necessary to design solutions tailored to the different needs within the EU territory. Our work has been to develop approaches based on multivariate statistical techniques that allow the identification of the different axes of socio-economic development and, subsequently, the segmentation of regions into more coherent and homogeneous clusters.

Credit Risk Analysis

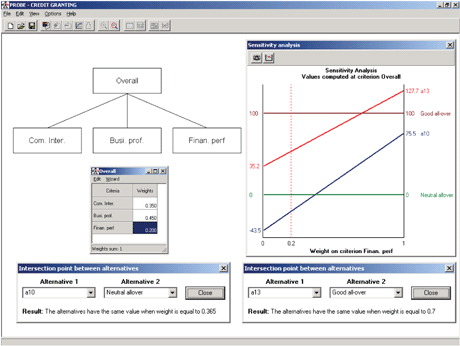

Segmentation, classification and multivariate statistical methods are also used in credit risk analysis, namely to help credit-granting decisions. For some types of loans, however, the modelling procedure must permit the inclusion of expert judgements, since qualitative criteria, particularly management's experience and reliability, show significant negative correlation with banks' default records. Within this context, we extended our work to the use of multicriteria decision analysis models as a way of assessing credit risk by integrating both qualitative and quantitative data.

Similarly, we developed a multicriteria value model for selecting and managing portfolios of financial assets. It consists in defining a benchmark portfolio and scoring its different stocks according to expected return criteria. A procedure is then proposed to suggest adjustments to the proportions of stocks in the portfolio. Finally, the risk is taken into consideration in an optimization module that includes constraints concerning the limits of variation for the proportion of each stock.

This approach is different from others found in the literature, eg mono-objective optimization with constraints associated to the different factors; and multi-objective and goal programming. The reason is the ambiguous nature of some indicators. Think of the interpretation of a usual market indicator: P/E, the price-to-earnings ratio. A high value of P/E, for instance, can indicate that the market expects future earnings to grow fast or that the company has a low risk. However, it can also reveal that the stock is overpriced. The question then is not whether the ratio is high or low, but whether or not one believes the market is correctly (efficiently) pricing the asset. A multicriteria value approach is well suited to the subjective (and complex) nature of investors' judgments on quantitative and qualitative criteria.

The final link in our conceptual chain adds multiple dimensions with flexibility and risk. The focus is again on the support of investment decisions, now in terms of real assets. Imagine that the decision to invest on a new industrial unit might be postponed, waiting for more information about the expected market behaviour. This postponement option as a value that can be estimated by adapting the usual financial option models to real assets. In this case, the volatility is assumed to be represented by the variation in prices of the subjacent asset (shares of the firm). However, projects are subject to multiple risks: variation in output price, variation in input prices, and among other things, uncertainty in the future prices of CO2 licences. These multiple sources of risk are not contemplated in option models. The solution we are working on is to use Monte Carlo methods to generate different streams of cash flow and to use their variance as a proxy for the volatility of the real options. Finally and in parallel, we are working on the development of multicriteria models to incorporate sustainable development concerns into the investment decisions framework.

Link:

https://fenix.ist.utl.pt/investigacao/ceg-ist/inicio

Please contact:

João Oliveira Soares

University of Lisbon, Portugal

E-mail: joaosoares![]() ist.utl.pt

ist.utl.pt